In any accounting software, it’s essential that the bank balance shown in the system matches the balance imported from your actual bank account.

This guide walks you through how to check and correct your bank balance in QuickBooks.

Finding Your Bank Balance in QuickBooks

To begin, select Transactions from the menu on the left side of the screen, then Bank Transactions. If you have multiple bank accounts, use the dropdown arrow next to the account name to switch between them.

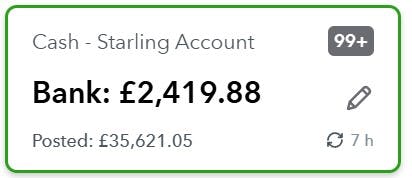

Under the account name, you’ll see two figures:

- Bank balance (from your bank feed).

- QuickBooks balance (based on reconciled and categorised transactions).

If these two figures don’t match, don’t panic - it often just means there are unreconciled items. In the example shown, QuickBooks is flagging over 99 transactions still needing attention, which explains the large difference.

Once everything is reconciled, the two balances should match. If they don’t, it’s time to investigate.

Step 1: Identify When the Balance Went Wrong

The main reconciliation screen won’t show you a running balance, so click Go to Bank Register. This opens a ledger-style view with a running balance on the right-hand side. The screen can feel cramped, so many users hide the left-hand menu to give themselves more space.

Now compare QuickBooks’ running balance to your actual bank statements. A good approach is:

- Check the balance at the end of a month.

- If it’s wrong, go back a month.

- If it’s correct, go forward a month.

This helps you narrow down the period where the error occurred. Once you’ve identified the month, you can drill down into specific dates to find the exact issue.

Step 2: Fix the Error

There are several common reasons why the QuickBooks balance may not match your bank balance. Here are the ones we see most often:

1. Incorrect Opening Balance

If your bank account existed before you connected it to QuickBooks, the opening balance may be missing or wrong. You may need to:

- Enter an opening balance, or;

- Add older transactions that weren’t imported automatically.

2. Savings “Pots” Being Imported

Some banks allow you to move money into internal “pots” or savings spaces. These aren’t real transactions in or out of your bank account, but QuickBooks imports them anyway.

To fix this:

- Tick the pot movement transactions.

- Select Exclude.

- If they’ve already been categorised, delete them instead.

QuickBooks will warn you that the transaction came from the bank feed - you can safely ignore this.

3. Payroll Transactions Duplicating

QuickBooks Payroll automatically posts a payment to your bank account on the day payroll is run, not when it’s actually paid. This results in duplicate wage payments.

The best fix is to:

- Create a Payroll Control account.

- Post the payroll journal there.

- When the real payment leaves your bank, categorise it to Payroll Control.

The Payroll Control account should therefore be zero, with the wages going through the bank account just once.

4. Missing Transactions

Occasionally, a transaction simply doesn’t import. Check your Excluded tab in case it was removed by mistake. If it’s not there, you can add it manually:

- Click New.

- Choose Expense or Receive Payment.

- Enter the correct date, amount, and bank account.

5. Extra Transactions That Shouldn’t Be There

Sometimes QuickBooks imports something twice or pulls in a transaction that doesn’t belong. You can delete these, but check first whether it should be posted to a different account instead.

Final Thoughts

There are many reasons why your QuickBooks bank balance might not match your real bank balance, but the steps above will help you track down the issue. If you’re ever unsure, your accountant should be able to help you work through the reconciliation and get everything back in line.