Part 1 of a three‑part series on understanding VAT

Most people have heard of VAT, but far fewer understand how it actually works in practice. This first article in the series covers the basics: What VAT is, who pays it, and how it flows through the supply chain.

What Is VAT?

VAT stands for Value Added Tax. It’s a tax applied to most goods and services sold in the UK. The principle is simple: Whenever value is added to a product or service, the government takes a percentage of that value as tax.

Who Pays VAT?

Although VAT is charged by businesses, the end consumer usually bears the full cost. This is because VAT‑registered businesses can reclaim the VAT they pay on their own purchases.

The only people who can’t reclaim VAT are:

- Individuals buying for personal use.

- Businesses that are not VAT registered.

This means the VAT burden ultimately falls on the first person in the chain who cannot reclaim it.

An Example of the VAT Chain

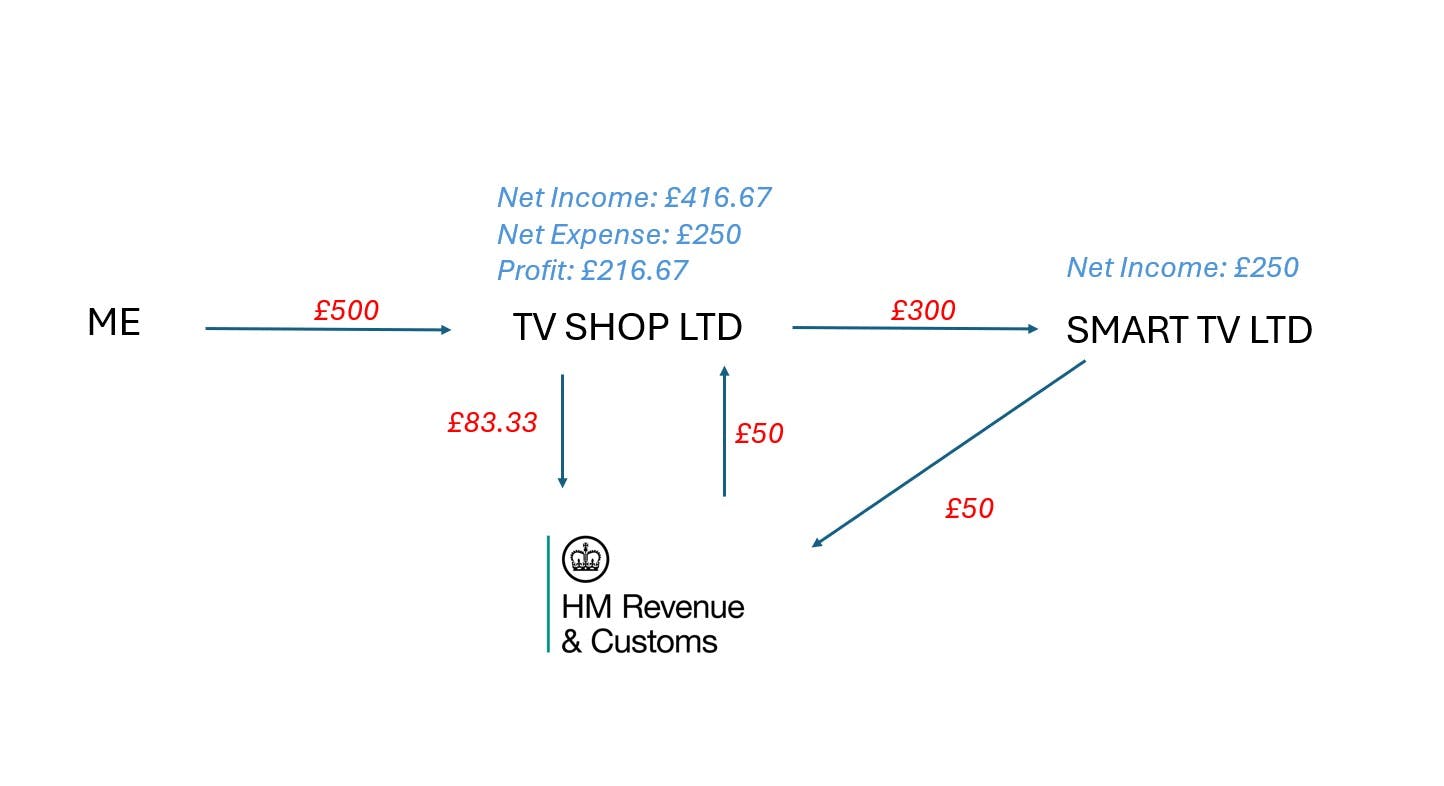

Let’s say I buy a new TV for £500 from TVShop Ltd, a VAT‑registered retailer.

- The shop’s net selling price is £416.67

- VAT at 20% is £83.33

- Total paid: £500

Because I’m buying it for personal use, I can’t reclaim the VAT.

If I were buying it for a VAT‑registered business, I could reclaim the £83.33.

To calculate the net price from a VAT‑inclusive total, use:

Total ÷ 120 × 100

What About the Supplier?

Assume TVShop Ltd bought the TV from SmartTV Ltd for £300 including VAT.

- SmartTV’s net price: £250

- VAT charged: £50

TVShop Ltd can reclaim the £50 VAT they paid to SmartTV. This is called input tax. The VAT they charge me (£83.33) is their output tax. When they file their VAT return, they pay HMRC the difference:

£83.33 output tax – £50 input tax = £33.33 owed to HMRC

Summary of the VAT Flow

Assuming SmartTV manufactures the TV themselves, the VAT position looks like this:

- Me (the consumer): Paid £83.33 VAT and cannot reclaim it.

- TVShop Ltd: Charged £83.33 VAT to me, paid £50 VAT to SmartTV, and therefore pays £33.33 to HMRC.

- SmartTV Ltd: Charged £50 VAT and pays that £50 to HMRC.

HMRC receives:

- £50 from SmartTV.

- £33.33 from TVShop, minus the refunded £50.

Total VAT received: £83.33 - all ultimately funded by the consumer.

This is how VAT works: it is always added on top of the price the seller wants to receive for their goods or services.

The diagram below should hopefully help to demonstrate this process.

What’s Next?

In the next article, I’ll cover:

- The different VAT rates.

- When you must register for VAT.

- When voluntary registration might be beneficial.